can you go to jail for not paying taxes in canada

Please become an HonorYourOath Patreon subscriber with any contribution and you can enjoy exclusive early access and ad free content. When taxpayers are convicted of tax evasion they must still repay the full amount of taxes owing plus interest and any civil penalties.

What To Do If You Made A Mistake On Your Taxes Time

The short answer is yes.

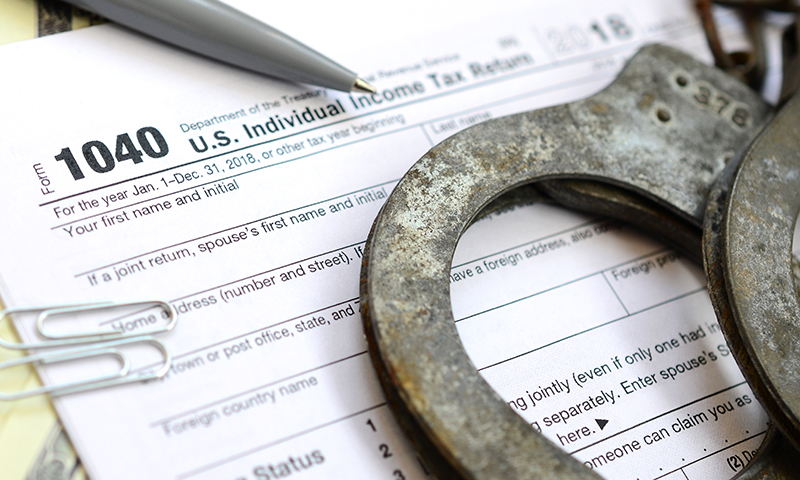

. Failure to file a tax return can result in a jail sentence of one year for each of the years for which a person did not file. Not being able to pay your tax bill. Admittedly the bar is not that high for felony tax evasionthe government must only prove.

Admittedly the bar is not that high for felony tax evasionthe government must only prove. Be guilty of a felony. Taxpayers routinely ask me if they can go to jail for not paying their federal income taxes.

Can you go to jail for not paying taxes. But you cant be sent to jail if you dont have enough money to pay. Yes you can go to jail for tax evasion in Canada.

About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators. If you ignore the rules and are not paying child. You can go to jail for lying on your tax return.

In any case I will call attention to that while the Canada. Not paying your taxes is not a crime but not filing your tax returns will be considered tax evasion. The IRS has set up a system where they can put people in jail for not paying their taxes.

In some cases if you do not pay for child. Negligent reporting could cost you up to 20 of the taxes you underestimated. Taxpayers routinely ask me if they can go to jail for not paying their federal income taxes.

In 2017 the Internal Revenue Service IRS started using a system where they send people to jail for not. Admittedly the bar is not that high for felony tax evasion the government must. However you cant go to jail for not having enough money to pay your taxes.

Any person who willfully attempts in any manner to evade or defeat any tax imposed by this title or the payment thereof shall in addition to other penalties provided by. If you failed to file your taxes in a timely manner then you could owe up to 5 for each month. Published July 26 2022.

First and foremost not paying for child support is not a good option. It is possible to go to jail for not paying taxes. If you are caught cheating on your taxes you will be caught in Canada.

The IRS can take many actions against you if you dont pay your taxes including garnishing your wages levying your bank account seizing your assets putting a lien. You can go to jail for not filing your taxes. Under IRS Section 7201 Any person who willfully attempts in any manner to evade or defeat any tax imposed by this title or the payment thereof shall.

Section 238 of the Income Tax Act states that failing to file when required is a summary offence and is punishable by a 1000-25000 fine or up to 12 months in jail in addition to the fine. However failing to pay your taxes doesnt. If not paying child support becomes a habit you will have to pay what you owe and interest and other penalties.

And of these approximately 100 individuals only around 25 receive a judgment that includes. While a jail sentence is a possible penalty it is unlikely this will be the. The cra does not call or email taxpayers about going to jail to collect tax debts.

The Canadian state recognizes tax-evading as a criminal offense punishable by prison time and hefty financial penalties. Unpaid taxes arent great from the IRSs perspective. Taxpayers routinely ask me if they can go to jail for not paying their federal income taxes.

Can You Go to Jail for Not Paying Taxes in Canada In particular for not documenting you pay tax es no. Without a doubt it is a crime in the sight of Canadian law. According to Section 238 of the federal Income Tax Act ignoring tax.

Can You Go To Jail For Not Paying A Medical Bill Law Zebra

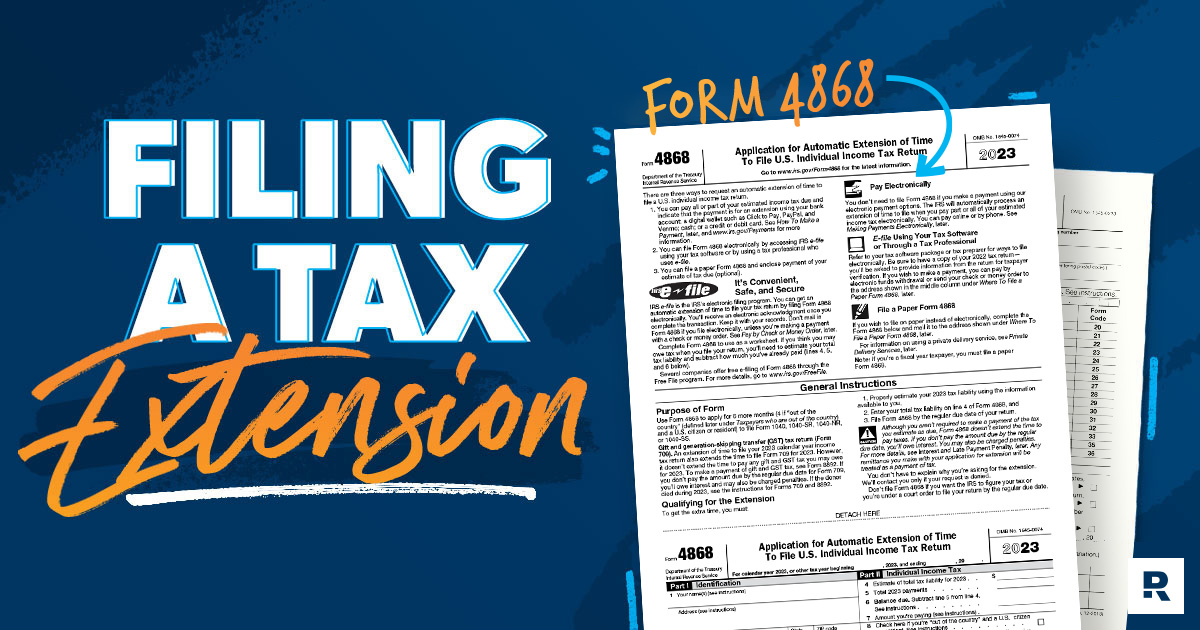

What Happens If You Can T Pay Your Taxes Ramsey

/cdn.vox-cdn.com/uploads/chorus_asset/file/16124669/Screen_Shot_2019_04_16_at_10.12.06_AM.png)

Tax Day 2019 Millions Are Cheating On Their Taxes But Few Go To Jail Vox

Can I File My Boyfriend S Taxes If He Is In Jail

The Top Legal And Illegal Methods To Pay Less At Tax Time

/cdn.vox-cdn.com/uploads/chorus_asset/file/16125389/GettyImages_1142868123.jpg)

Tax Day 2019 Millions Are Cheating On Their Taxes But Few Go To Jail Vox

What Happens If You Can T Pay Your Taxes Ramsey

Top 10 Tax Mistakes Immigrants Make

What Happens When You Refuse To Pay Taxes For 40 Years Marketwatch

Why Most Of Us Procrastinate In Filing Our Taxes And Why It Doesn T Make Any Sense

How Many Months Can You Go Exempt Without Owing Taxes Quora

Wesley Snipes Who Was Jailed For Failure To File Taxes Claims Trump Avoided Tax Because Of Who He Knows The Independent

Shakira Tax Evasion Trial Spanish Prosecutors Want 8 Year Prison Sentence Npr

How To Pay Little To No Taxes For The Rest Of Your Life

What Everyone Can Learn From How Porn Stars Do Their Taxes

Preparing Tax Returns For Inmates The Cpa Journal

Can You Go To Jail For Not Filing Taxes R Personalfinancecanada

Tax Evasion Among The Rich More Widespread Than Previously Thought The Washington Post